Narvi: Revolutionising banking in the Nordics

By Ndéla Faye | Photos: Narvi

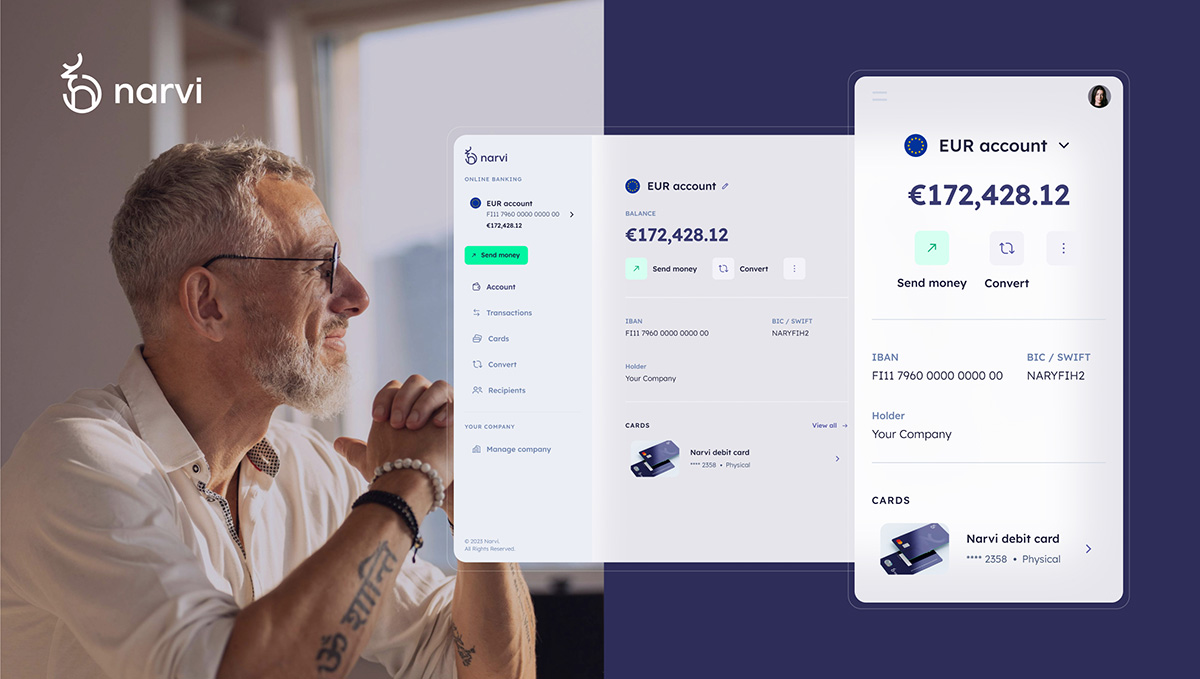

There is a hidden fintech revolution happening in Finland – and Narvi is at the forefront of it. Narvi, an alternative to your traditional business bank account, has set an ambitious standard for itself: crafting a banking product meticulously tailored to the needs of global businesses.

In an era where global business complexities are on the rise, traditional banks often find themselves struggling to keep pace with the rapidly evolving landscape and the dynamic needs of their clientele. While many fintech firms have prioritised and focused solely on scalability, Narvi distinguishes itself by providing exceptional customer support and being a private banker of sorts to small and medium-sized enterprises.

For the company, providing a smooth and quick service to clients is essential to their purpose. In short, Narvi has three goals: to provide a flexible payment technology with a human touch, offer personalised support for each client, and advise and tailor a payment solution that comprehensively addresses clients’ business requirements.

Making banking better

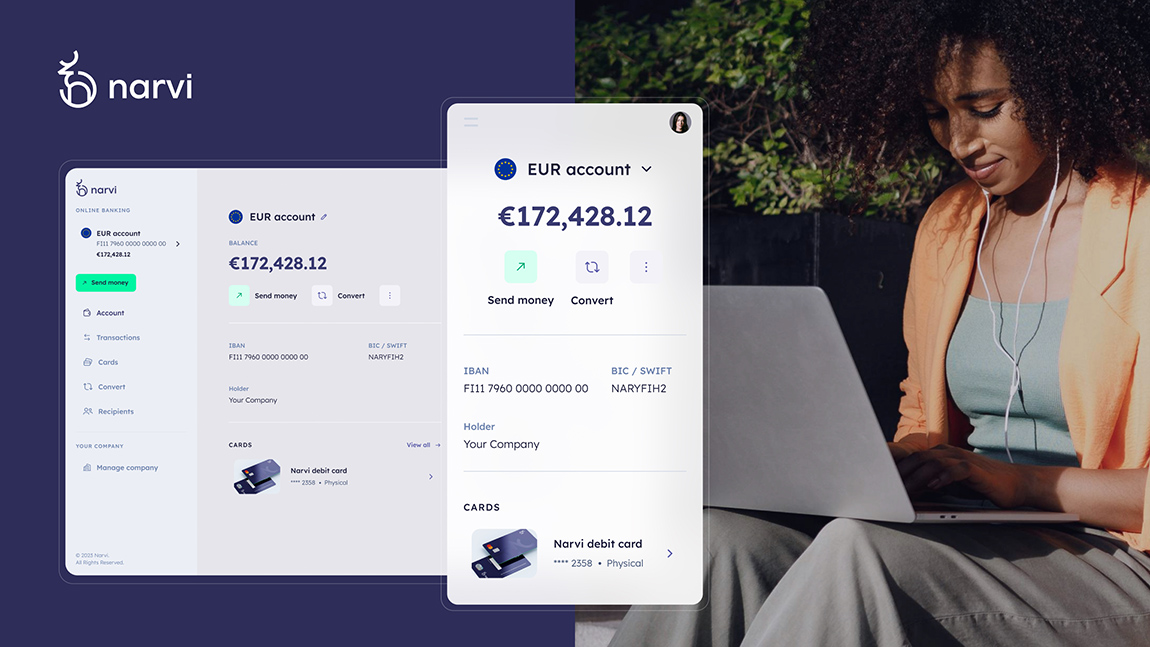

Narvi’s powerful integrated solution works seamlessly with local and international customers and suppliers. We want to reinvent global business banking – and make it better,” says Neil Ambikar, Narvi’s chief financial officer and co-founder.

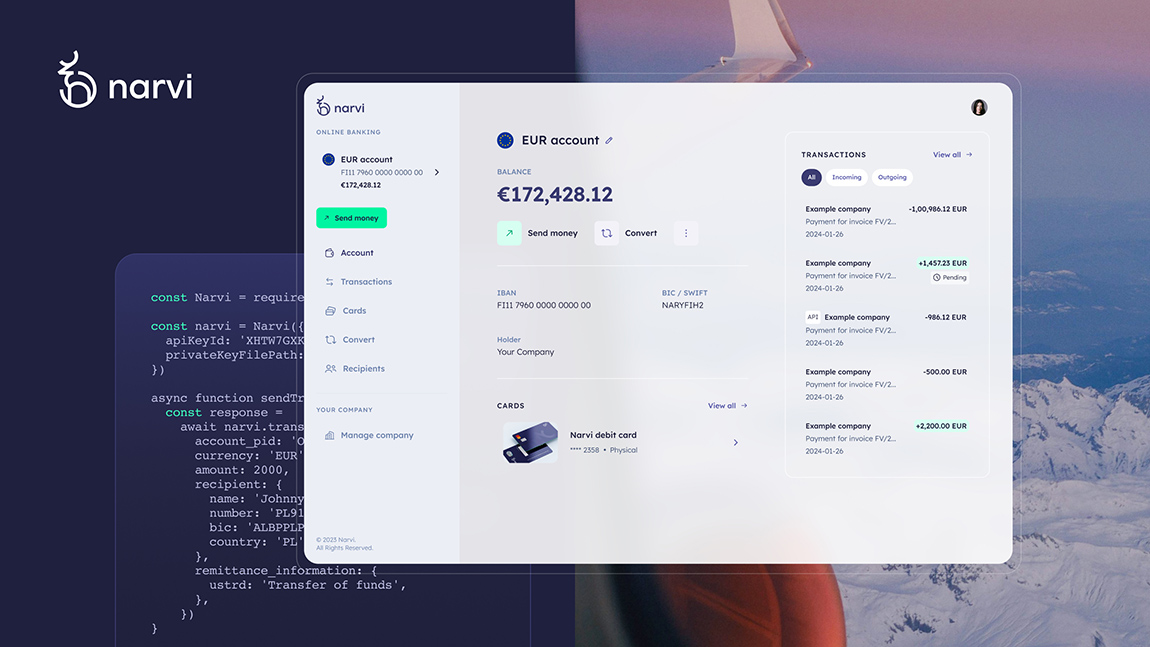

Regulated as an Electronic Money Institution (EMI) in Finland, Narvi’s distinctiveness stems from its in-house development of core banking technology. This bespoke infrastructure not only ensures a smoother and more streamlined banking experience for users but also facilitates API-first banking services for businesses. “Our agile technological framework enables us to swiftly integrate new features, ensuring that we remain at the vanguard of modern digital banking,” Ambikar explains.

“Our experience in this market tells us that a large number of higher-turnover digital businesses are increasingly looking for a solution that is customisable and offers strong support.”

With clients spanning Europe and beyond, Narvi’s system supports SEPA as well as global payments, enabling seamless transactions across more than 100 countries. Moreover, Narvi has to adhere to strict safeguards and regulatory standards, and all of Narvi’s customers’ funds are held at reputable banks in the European Union.

Narvi’s innovative platform and extensive know-how empower companies to expand their global footprint while offering a seamless and expedited interface that allows businesses to concentrate on their core operations. “At Narvi, we are driven by our commitment to infuse the renowned Nordic ethos of trustworthiness and reliability into international banking. We are building the future of banking services,” Ambikar concludes.

Web: www.narvi.com LinkedIn: Narvi-com

Subscribe to Our Newsletter

Receive our monthly newsletter by email